Adulting can be hard, I know, but we all have to embrace it. And one of the most significant responsibilities that comes with it is being financially responsible. And yes, I know, this isn’t the most exciting task on your to-do list. But let me say that if you are excited about getting a steady paycheck, then you should be just as excited about making sure most of your money stays with you.

And by that, I mean making sure you have a budget for your taxes, and file your W-4 properly and budgeting. We’ll explain to you in five easy steps in order to avoid any unpleasant experience before next spring.

So, fear not! We’re here to help you figure it out.

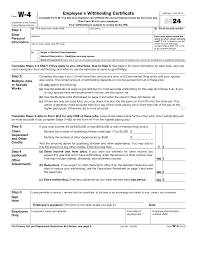

What is the W-4 tax form?

Its official name is the Employee’s Withholding Certificate, and the answer to what it is is in its name. The W-4 tax form applies to all employees in the country. Not only that, but we’ll break down the events that would require you to update your W-4 form.

The W-4 form is one of those pesky but necessary documents you’ll need to fill out before getting your first paycheck and give to your employer.

Do you need to fill out a W-4 tax form?

You’re probably starting your very first job, or maybe you’ve just accepted a job at a new place. Or you may have gone through significant life or financial changes. If any of these apply to you, it means you have to fill out the W-4 tax form.

Decoding the W-4 Tax Form: How Does It Impact Your Paycheck?

The W-4 is used to figure out how much of your paycheck will be withheld for the purpose of federal income tax. Through this form, your employer can calculate the exact amount of tax that needs to be withheld from each paycheck.

That’s right, it’s their problem to figure out the calculation. But do your part accurately, too, because if too little tax is withheld, you may end up owing money come tax time. Conversely, withholding too much tax could mean a smaller paycheck throughout the year.

So, let this be very clear. Understanding the W-4 form is crucial to ensure that you have the correct amount of taxes withheld from your paycheck. Because failure to accurately complete the W-4 form can result in over or underpayment of taxes. Do you really want to suffer serious financial consequences?

Just imagine, overpaying taxes means that you are giving the government an interest-free loan! And if you underpay your taxes, that can lead to a tax bill that you may not be prepared to pay next year.

Not only that, but the tax laws and regulations are constantly evolving, and updates to the W-4 form are made periodically. These constant changes make getting financial advice worth looking into.

Mastering W-4 Form Completion: 5 Simple Steps to Optimize Your Tax Withholding

Step 1: Enter Personal Information

You’ll need to give up some personal info, like your name, Social Security number, and address. It’s all on the W-4 form, so grab that bad boy and let’s get started.

Step 2: Managing Multiple Jobs and Spouse’s Income

Answer this: Do you have more than one at a time? If yes, you must do this step.

Or answer this: Do you have a spouse and file your taxes jointly? If yes, you must also do this step.

Here’s the tricky part. But there is a handy tool from the IRS Tax Withholding Estimator

If you have multiple jobs or if you and your spouse both work, it’s important to adjust your tax withholding.

For the job that pays the most, fill out steps 2 through 4(b) of the W-4 form, but leave those steps blank for your other jobs.

If you and your spouse make about the same amount, you can check box 2(c) on both W-4s.

If you don’t want your employer to know about your second job, you can instruct them to withhold extra tax or send estimated tax payments to the IRS on your own.

Step 3: Maximizing Tax Credits and Deductions Dependent and Other Credits

If you make less than $200,000 (or $400,000 if you file jointly), you could score some sweet tax credits by entering the number of kids and dependents you have and multiplying them by the credit amount. It’s a total win-win – more dependents means more credits for you!

But, even with dependents, you can still lower your taxes. How? You can choose to not claim them, then have more taxes taken out of your paycheck. Boom – problem solved.

Step 4: Optional Adjustments for Tax Withholding

These are the three things you can do to manage your tax withholding on your W-4 form. They cover income from interest or dividends, deductions other than the standard deductions, and additional taxes withheld in order to avoid a large tax bill later on. But it’s optional.

Step 5: Ensuring Accuracy: Signing and Submitting Your W-4 Form

As soon as you double-check that everything is accurate, sign your name, fill out today’s date, and you’re done! Give the form to your employer or to payroll. And if your employer provides an online payroll system, then skip the paper form and do it there.

Tips for Year-Round Tax Planning and Compliance

The W-4 form is a crucial document that you must complete and submit to your employer to determine how much federal income tax should be withheld from your paycheck. It’s important to understand the purpose of the form, determine your filing status, calculate the number of personal allowances, consider any additional income or adjustments, and account for any multiple jobs or two-earner households.

Remember, you can always refer back to this post as a resource during tax season. It can be easy to forget some of the key points covered in the W-4 form, especially if you don’t complete it very often. By bookmarking this post, you can quickly reference the information you need and ensure you’re completing the form correctly.

Leave a Reply